Over 10,000 user sign-ups and 300+ groups within the first 3 months

Designing Social Banking for Groups

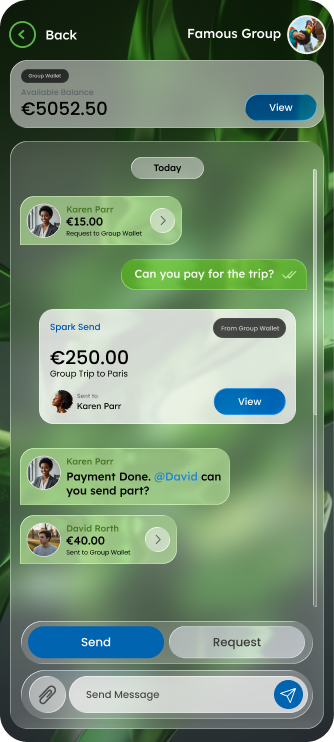

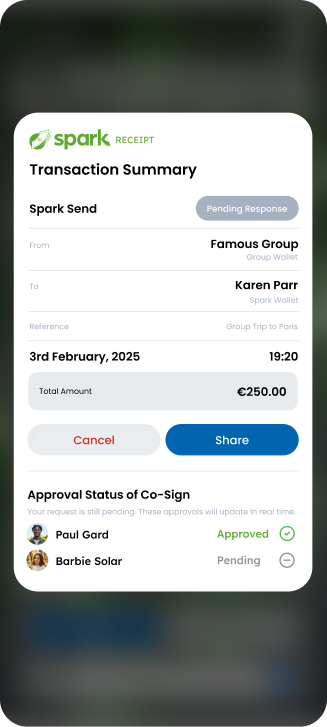

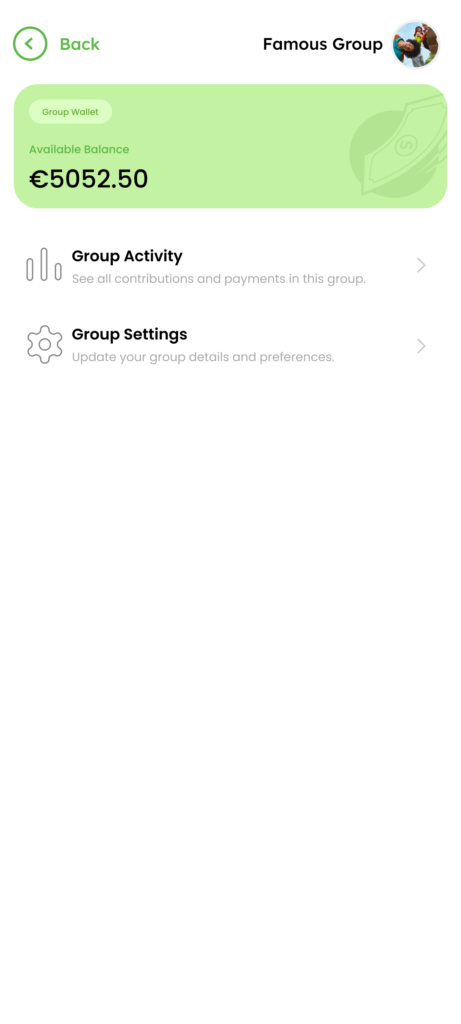

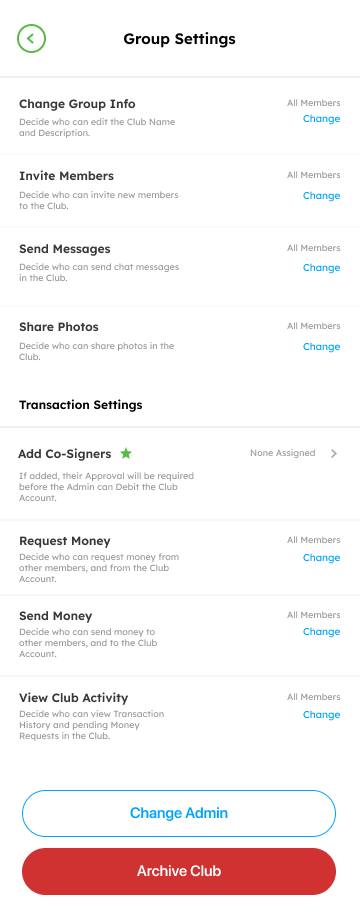

A social fintech platform that merges chat with a shared group wallet and multi-approver governance to make group saving and spending transparent and safe.

The choice of thousands

100K

Reached in 2 months of launch

750

Pre-seed raised

My role

Business/Product Designer & UX Lead

I worked closely with co-founders to design an operable, trustless group-finance system: user roles, governance rules, ops workflows, third-party integrations, compliance constraints, and the end-to-end product experience.

Tools used

What I owned/Experience

Business/service design (roles, governance, ops workflows)

UX/UI & design system

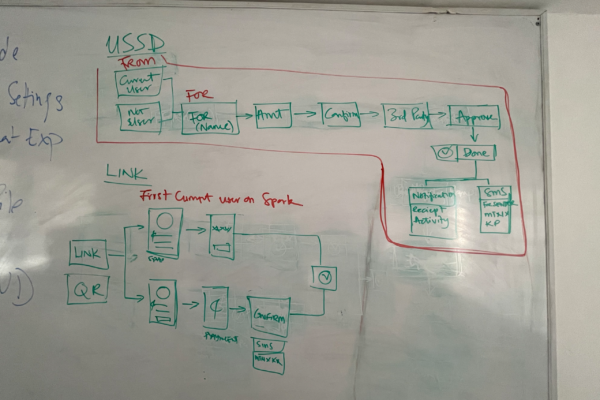

Integrations mapping (payment rails, KYC, OTP/bulk messaging)

Testing with QA & external users (incl. A/B testing)

Brand, investor decks, website, GTM support assets

Problem

Informal savings and spending groups rely on WhatsApp chats, screenshots, and a treasurer’s personal account to manage shared funds, which creates fraud risk, poor visibility into where money goes, messy records, and frequent disputes, so they need a simple chat-native system with built-in transparency and approvals to manage group money safely.

What breaks

Mistrust / fraud risk

Treasurer can move or disappear with funds

Low visibility

'Where did the money go?'

Messy records

screenshots ≠ ledger, disputes escalate

Worked with

Co-founders (product/business/tech leadership)

Engineering: iOS/Android, backend/database

Operations (KYC, support, edge-case resolution)

QA (internal & external testing)

Sales/Marketing (GTM assets and creative direction)

Users (interviews, surveys, focus group A/B)

The Goal

A simple trustless system that makes group finance transparent, governed, and easier to manage.

User & Use Cases

Process

Discovery & validation

Informal savings and spending groups rely on WhatsApp chats, screenshots, and a treasurer’s personal account to manage shared funds, which creates fraud risk, poor visibility into where money goes, messy records, and frequent disputes, so they need a simple chat-native system with built-in transparency and approvals to manage group money safely.

Interviews, surveys, desk research, personal observation

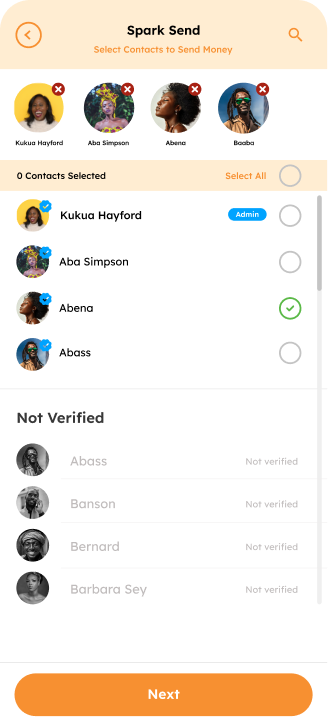

Mapped users: admin/member, Spark ops and third-party integrations

Defined success: clarity, trust, task completion efficiency

Design & Delivery

Informal savings and spending groups rely on WhatsApp chats, screenshots, and a treasurer’s personal account to manage shared funds, which creates fraud risk, poor visibility into where money goes, messy records, and frequent disputes, so they need a simple chat-native system with built-in transparency and approvals to manage group money safely.

Flows, UI, design system, and documentation

Notification matrix and operational handling for edge cases

QA cycles and external testing and A/B experiments

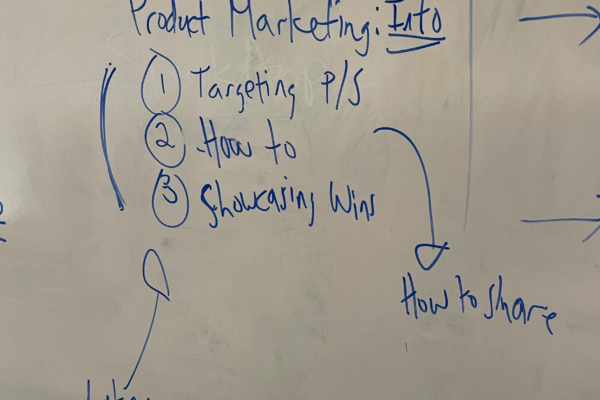

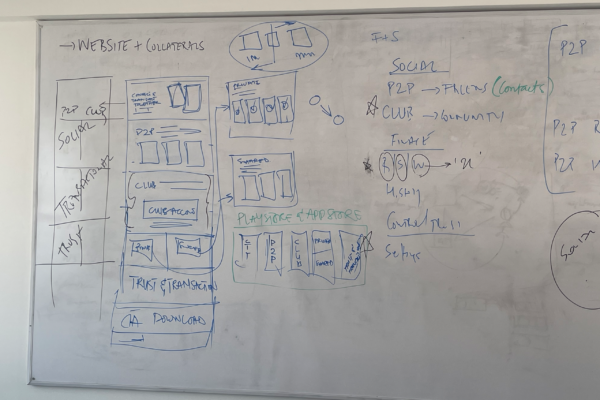

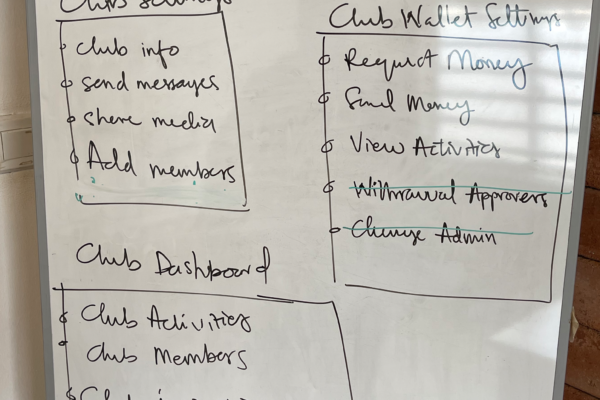

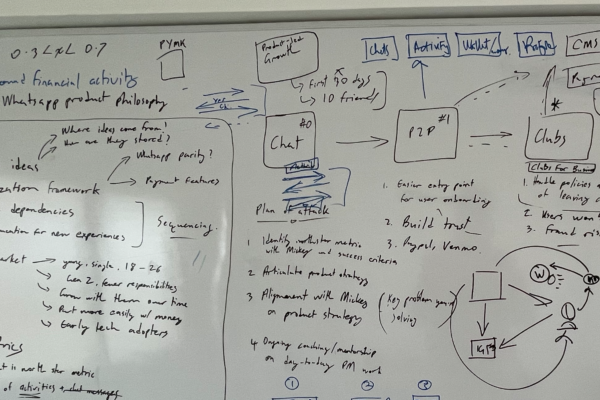

White-boarding Sessions

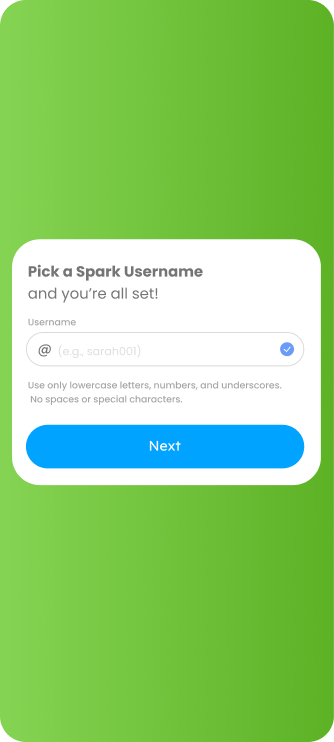

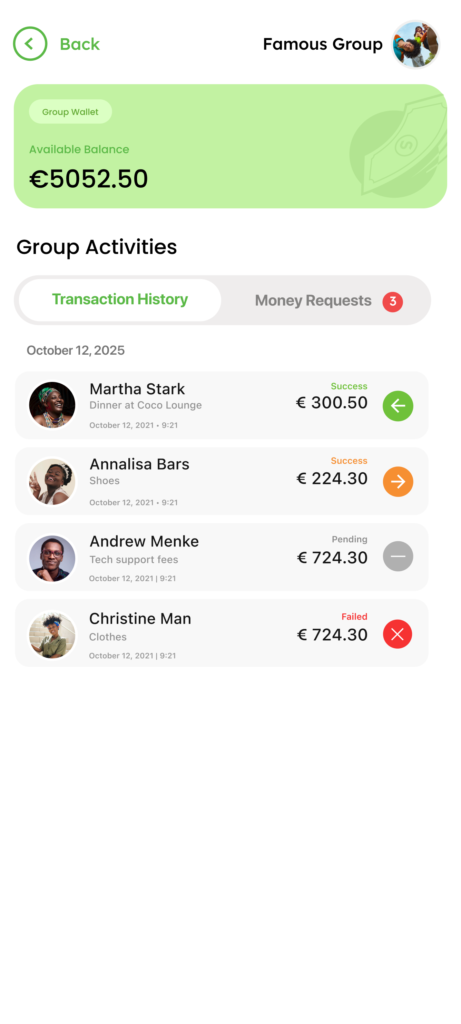

App Screen Shots

Learnings

What was hard

Balancing chat simplicity with financial clarity

Trust & safety design

Edge cases: refunds, disputes, late payments

Onboarding & education

Regulatory/compliance assumptions and wallet model decisions

Pivoting too fast based on early adoption signals

What I’d improve

Test features longer before pivoting; define ‘kill/keep’ thresholds

Improve inactive approver resolution and dispute handling

Expand analytics instrumentation for feature adoption decisions

Key Learning

Some research signals were misleading

(e.g., ‘money request’ looked essential but underperformed).